It’s county fair season here in Oregon, which I love. We enjoy going to our county fair to see the animals, all the 4-H projects, check out the vendor hall, and eat some fair food. Every time we go my kids ask for money. Does this sound familiar?

Whether it’s to ride some rides, get some food, or something else, they ask good ol’ dad for some cash. Maybe I give them each $5 to spend how they wish.

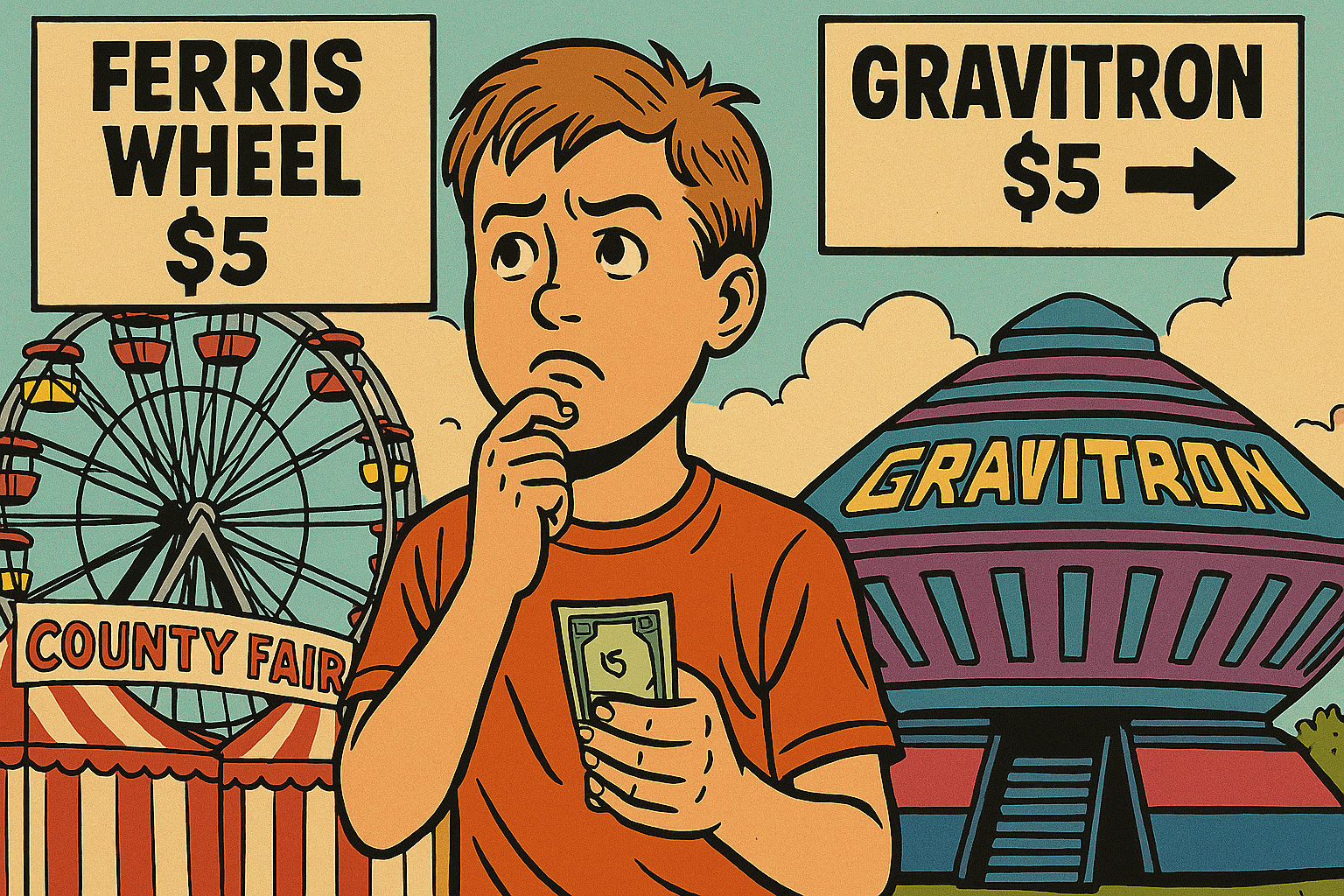

If you’ve been in a similar situation, you know what comes next…the agonizing decision on how to spend the money!

Whether they realize it or not, all kids in this situation implicitly understand the economic principle of “opportunity cost.”

Opportunity cost is the value of the next best option that is given up as the result of choosing first option.

Let’s consider an example from the county fair.

If the Ferris wheel, the Gravitron, a funnel cake, and a corn dog each cost $5, your kid realizes that he can only pick one at the exclusion of all the others.

In situations like this, we naturally make value judgements and rank our opportunities, weighing the pros and cons of each. Let’s say that one child ranks his choices as:

- Gravitron

- Ferris Wheel

- Corn dog

- Elephant ear

If he chooses to ride the Gravitron, then he gives up the opportunity to ride the Ferris Wheel or buy a corn dog or funnel cake. The “cost” of riding the Gravitron is the giving up the fun of riding the Ferris Wheel or getting a snack. This is the essence of opportunity cost.

When our resources do not meet all our demands, then we must rank our choices and make a selection based on how we value our options. (Opportunity cost is not just about money or material resources but also about how we choose to spend our time. Our family cannot go to the county fair and go for hike at the same time, we have to choose.)

You may notice that the ranking is subjective or personal. A second child may rank her choices differently and thus have different opportunity costs. Maybe she really wants a funnel cake!

It gets trickier when multiple people with different preferences try to make a decision together. Maybe your two kids want to go on a ride together but one wants te ride the Ferris Wheel while the other prefers the Gravitron. Let the negotiations begin!

This is a simple example, but we face opportunity costs throughout our lives and on things that can be quite consequential.

For example, if you have extra money left over from your paycheck should you:

- Invest it for retirement,

- Save for a child’s college education, or

- Make an extra mortgage principal payment?

These are very real choices for many people and with limited resources we cannot do everything. If the money is invested in an IRA then it can’t, at the same time, be used to pay down the mortgage or pay for college.

Every time we make a budget or spending plan opportunity costs come into play. We have a finite income and must decide how to allocate the funds across multiple needs, wants, and desires. If you’re married, you know it is not always easy to agree on how to rank priorities!

So we need wisdom to evaluate and value our choices and decide on our priorities. This is where prayer and advice from others can help.

Opportunity costs also come into play at the national level when Congress tries to set the budget but only has a finite pool of tax dollars to use. Remember that values are individual and personal, so with 100 Senators and 435 Representatives getting them all to agree is impossible.

With a seemingly infinite list of “wants” Congress ideally decides what is most important and allocates money towards that. (Unfortunately, they often spend money that doesn’t exist and then inflate the currency to pay for it. But that’s a topic for another day!)

From kids at the fair to Representatives and Senators, we all deal with opportunity cost so it’s a good concept to understand and a key economic principle!

For a great explanation of this and other basic economic principles, check out this great video!